Is solar really a no brainer (part 2)

*This article is for residential buyers

Welcome back, in the first post we explored whether solar is really a no-brainer, viewing through the lens of a buyer using a home equity loan. The same ideas were also relevant to alternative funding options such as Q-Card & Gem Visa, although the rates and terms are never as good with those options, for reasons I won't bore you with.

In this post I we will explore the idea from the second camp of people. Those with cash in the bank, who are considering solar as a means to park their cash and get reasonable returns.

The main question is, how does solar compare to other places you can park your cash?

How does solar stack up as an investment?

Setting the premise, it's important to consider risk, and the emotional rollercoaster attached to varying levels of risk. For example; I have a friend who always talks about bitcoin as the best place to park cash, but there's a serious disconnect between his words and reality, because he checks the price of bitcoin every other hour.

An investment should be measured by two things.

- The investment returns

- The time, energy and effort required by the asset owner to achieve said returns.

Further to point above, my friend with the bitcoin might do well in the long term, but that's only if he doesn't sell next time it drops 50%. And further to that, is it really considered winning if a $10,000 investment doubles, at the cost of sleep?

The main investment options

- Stocks.

We're all stock investors by means of our Kiwisaver, and the NZ government super fund. History shows that stocks provide returns in the vicinity of 6 - 8% over the long term. Included in that 6-8% is dividends, which typically make up less than .2% of the 6-8%, and capital gains, which reflect rising equity prices.

Stocks come with a similar emotional rollercoaster to Bitcoin, as in, they go down from time to time. But over a 15 - 20 year period, it's safe to assume the asset holder will yield a 7% return every year, which compounds.

If you put $15,000 in the stock market, you could reasonably expect that investment to be worth $81,000 after 25 years, assuming you reinvested the dividends.

But of course, in a stock market downturn, that $81,000 could be discounted due to 'Mr Market', and therefore, may only be worth $60,000 or something close to that. Swings and roundabouts, that's the nature of stocks. The minimal tax cost on dividends has not been factored. - Term deposits.

This conversation is interesting, because term deposit yields are all over the place, and depending how you structure the term, the returns don't compound.

Just a few years ago, term deposits were yielding less than 2%, and now they're sitting around 6%.

Nobody can crystal ball the deposit rate, for if they could, they'd be infinitely rich.

So, lets assume a 25 year average deposit rate of 4%, which may actually be too high. And lets assume that the holder takes out bi-annual deposit terms to allow the interest to compound (somewhat).

$15,000 invested in 2 year term deposits, yielding a 4% interest rate, compounding every 2 years, comes in at just over $38,000.

But, assuming a 25% tax rate on the interest earned, the $15,000 only grows into $33,000.

If a lower tax rate is assumed, say 17.5%, the $15,000 grows to something closer to $35,000.

Of course, term deposits come with practically no risk and no heartache. - Investment trusts.

A lot of kiwis like to place their cash in investment trusts that hold loans secured by property. Returns in these asset classes typically pull in about 7%, annually, and you can generally opt to have the returns reinvested to keep the compound machine in motion.

However, just like term deposits, you are liable for tax on those quarterly dividend payments.

In this case, I'll assume a 17.5% tax rate. This is pretty standard, but also conservative.

Assuming a 7% annual dividend, taxed at 17.5%, and reinvested annually, $15,000 grows to $63,735.

So, how does solar compare?

Lets recap. $15,000 ...

Stocks

-> $81,000 if you time it right. Probably something closer to $70,000 considering the vicissitudes of life.

Term deposits -> $35,000 with small tax rate.

Investment trusts -> $63,735.

Residential solar, without a battery, tends to come with a 7 - 8 year payback period. That's true for most regions, but it can be higher in areas with high power rates.

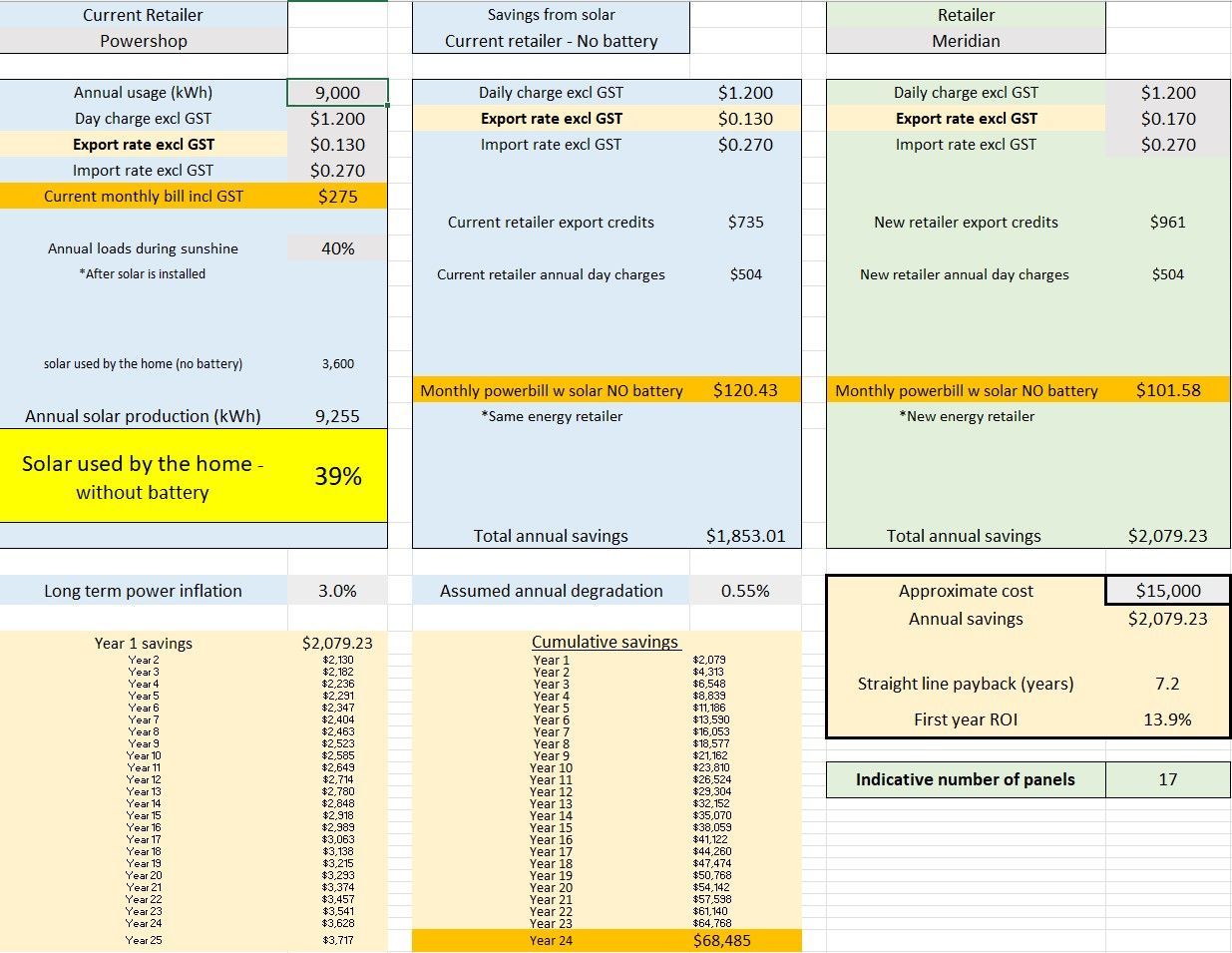

In the example captioned below, a 13.9% 1st year return is demonstrated.

On a 1st year basis, solar beats the low risk options with respect to the return, coupon, dividend, however you wish to call it.

Over 25 years, $15,000 in solar would grow to over $68,000 - which is similar to that of stocks, but without the heartache.

This is a great result, which demonstrates the benefit of energy savings being intangible and non-taxable.

That's assuming:

17c solar buyback rates, no GST payable.

27c per kW excluding GST.

40% of the homes energy use occurs at daytime, to benefit from solar. (Easy with a hot water cylinder heating during sunlight hours).

3% power inflation rate.

.55% annual solar panel degradation.

The great thing about solar is that you're relying on the sun rising. If you use more energy in your home, your savings go up respectively.

And for the record, I've factored in the degradation of solar panels at .55% per year.

If you don't clean them and consequently they degrade at 1.55% per year, $15,000 still turns into $60,037.

But you should clean them. It looks tidy 😉

*You can factor in about $20 a panel for a professional cleaner, and can do it bi-annually for best performance without incurring too much expense.

Our two cents

Solar checks out as a great investment. There's no panic involved. The sun the rises, and you save money.

The returns are positive. Not immensely better than the other options available to you, but in the long run everything checks out.

What's of utmost importance, is caring for our environment. We need more solar, and we need more EVs powered by solar panels.

As the world gets better at producing solar batteries, they'll come down in price. With power prices going up, and batteries coming down, solar buyers can look forward to getting very positive investment returns on solar + batteries.

We will explore the benefit of batteries in a future blog.

For now, why not 'engage a solar broker'; so we can mutually explore the right system for your home, and get to work on getting you the ideal system at the ideal price.

Much love.

Rowan Ellis

Founder | Equity Solar Broker's

rowan@equitysolar.co.nz

Save time & Money; book a solar broker to

We will get back to you as soon as possible.

Please try again later.